What are the 5 steps to fundraising for female founders?

Access to funding is the top barrier to entrepreneurship for women across the entire entrepreneurial journey, with female founders feeling 81 per cent less likely than men that they can access the finance they need for their start-up.[i]

The thought of raising investment can feel overwhelming, especially for female founders. Ask any woman who's leading a high growth start up, and they’ll tell you they already have way too much on their plate. Embarking on the task of going out to fundraise can feel like you're at the bottom of a mountain, with that money you need right at the top of it, and it's going to be a long and tough climb to get there (if you get there at all).

But leading a start-up doesn’t mean you have to put in a 100-hour week – it’s about working smarter, not harder. And that principle also applies to the process of raising investment. Fundraising successfully while running your business, dealing with life and staying sane is about breaking down the task ahead into bite-sized chunks, so you don’t become overwhelmed. It's a step-by-step process.

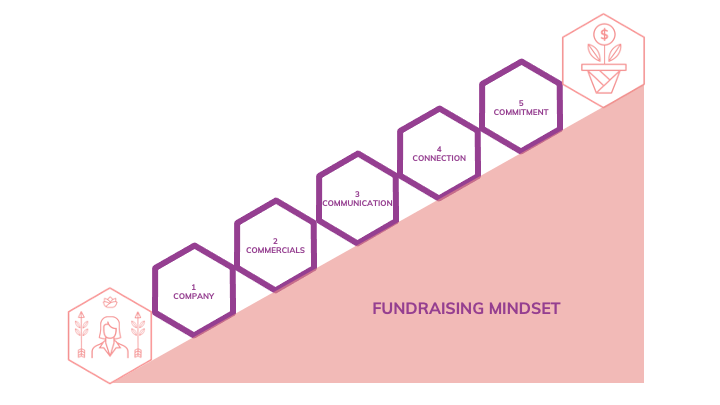

Step 1: Company

You'll need to show investors you’ve got an investable business with huge potential to scale, a strong plan for growth, and a team which can execute. To be successful on your raise, you must be able to articulate your business plan, know how investors will assess the opportunity and learn how to strengthen your proposal.

Step 2: Commercials

It will be critical to demonstrate well thought-through financial projections and an attractive investment deal to potential investors. That means building strong financial forecasts, working out how much investment to raise, determining your company valuation, and structuring your investment deal well.

Step 3: Communication

When fundraising, you'll have to explain the opportunity to investors clearly and succinctly. That means learning to speak the language of investors, building a compelling investment narrative, developing your pitch deck, and communicating your true value.

Step 4: Connection

You'll need to attract the right investors who'll add real value to your business. So, you'll need to first determine which investors are right for you, then learn how to find and reach out to them, and of course make sure you run your investment campaign effectively.

Step 5: Commitment

Successful fundraising means running effective investor meetings, and negotiating and closing a great deal. You'll need to know exactly how to have the most productive investor conversations, close their commitment on backing you and negotiate your deal to build long-term value. The deal isn't done until you've got the money in the bank!

Fundraising Mindset

Your fundraising mindset underpins all these steps, as you need to keep that strong throughout the whole fundraising journey. It's the extra factor that makes the difference between failure and success on your journey, providing you with bulletproof confidence. You'll need to discover how to keep your mindset strong, stay focused, build resilience, and remain authentic through the fundraising process.

Why must you get all five right – and in the right order?

Following the 5 Steps in the right order is absolutely critical for a number of reasons:

- There's no point in spending all your energy connecting with investors, trying to see if they’ll back you, if you aren’t able to show them you’ve got a business that’s investable or you don’t have a sensible deal proposal. The value proposition won’t be clear.

- You can have an incredible business, with strong and well-based financial projections, but if you’re unable to communicate effectively to potential investors, you’re going to get nowhere. They won’t be able to see the opportunity.

- Communicating your proposition with well-crafted outreach messages and a stellar investor presentation is all well and good, but if you’re speaking to the wrong investors, you’re wasting your time. You’ll be knocking on closed doors.

- You can do a brilliant job at getting in front of the perfect investor, but if you walk into that meeting and don’t know how to handle yourself, can’t communicate the opportunity or don’t have a clue how to get the best deal, you’ll struggle. You won’t get an offer, or you’ll sign a poor deal that won’t benefit you in the long term.

Develop your skills and get the right support

Fundraising is something you may end up doing time and again as you build and grow your start-up: it’s a key part of your role as a founder and entrepreneurial leader, so empowering yourself with the strategy, skills and support to be successful in raising investment is absolutely critical.

First step: check out our

Female Founder

Investability Scorecard ™.

It's a free, confidential test that measures your potential to raise investment by analysing your performance across 5 key areas. Your unique score will reveal your personal strengths and weaknesses and deliver practical, actionable tips to improve your results and help you secure the funding you need.

Next, to get the right support through all five steps of the fundraising process, join our

Fundraising Academy for Female Founders where you'll learn how to raise investment and be guided through the whole fundraising journey. You’ll be able to confidently communicate the business opportunity, reach and pitch to your ideal investors, secure their commitment and negotiate your deal.

Subscribe to the podcast

In our Fundraising Stories podcast, we showcase inspirational interviews with female founders who share their honest experiences of fundraising – the highs, the lows, the challenges… and top tips for how to be successful.

Make sure you never miss a show by subscribing, and please rate and review, so that other female founders and professionals in the investment community can discover it.

Book an Accelerator Session

30m - Jump start

£150+VAT

- ask one or two questions

- fast feedback on your Investability

- initial advice on your fundraising approach

60m - Tank up

£300+VAT

- ask three or more questions

- review your pitch deck or financials

- step-by-step strategy and action plan

90m - Rocket fuel

£450+VAT

- ask as many questions as you can!

- review all your pitch assets

- full guidance on how to find your ideal investors

-

"Working with Enter The Arena has been the best investment into myself and my business that I have ever made"

Claire Ransom, Founder, Lazy Flora -

"Julia was instrumental in our fundraising efforts, and I can't recommend her highly enough"

Vanessa Jacobs, Founder, The Restory -

"I honestly feel like I've got an MBA in raising finance in the last 90 days! I don't see anything in the way of us being successful now"

Tersha Willis, Co-Founder, Terrible Merch -

"... such incredible insight, strategic support, and true female power to help me step into being a successful entrepreneur"

Sophie Hooper, Founder, Secret Saviours -

"The positive and competent support and advice along my business growth journey have exceeded my expectations"

Maria Tibblin, Founder, Maria Tibblin

"Working with Julia has helped build my knowledge and confidence, but more than anything it has helped me to feel less alone on the journey"

Sharon Peake, Founder, Shape Talent

"Enter the Arena has has increased my confidence 10 fold on our investment journey."

Samina Courtin, Founder, Mon Dessert

“The Fundraising Academy is in a different league. To anyone considering investing in their fundraising journey, start here."

Andrea Cockerton, DIUO

Copyright Enter The Arena Ltd 2024